Business ownership is as much a part of the American dream as white picket fences and apple pie. Many people harbor the secret wish that they could go from employee to employer, but making that wish come true isn’t easy.

To start and sustain a business these days requires bravery, smarts, and a willingness to learn from failure.

Are you up to the task?

Keep reading to learn more about different ways you can finance your startup dreams without dealing with the rigid rules and regulations that are common at most traditional financial institutions. Then contact The Commercial Finance Group to learn more about how we can make your dreams of successful business ownership come true through factoring.

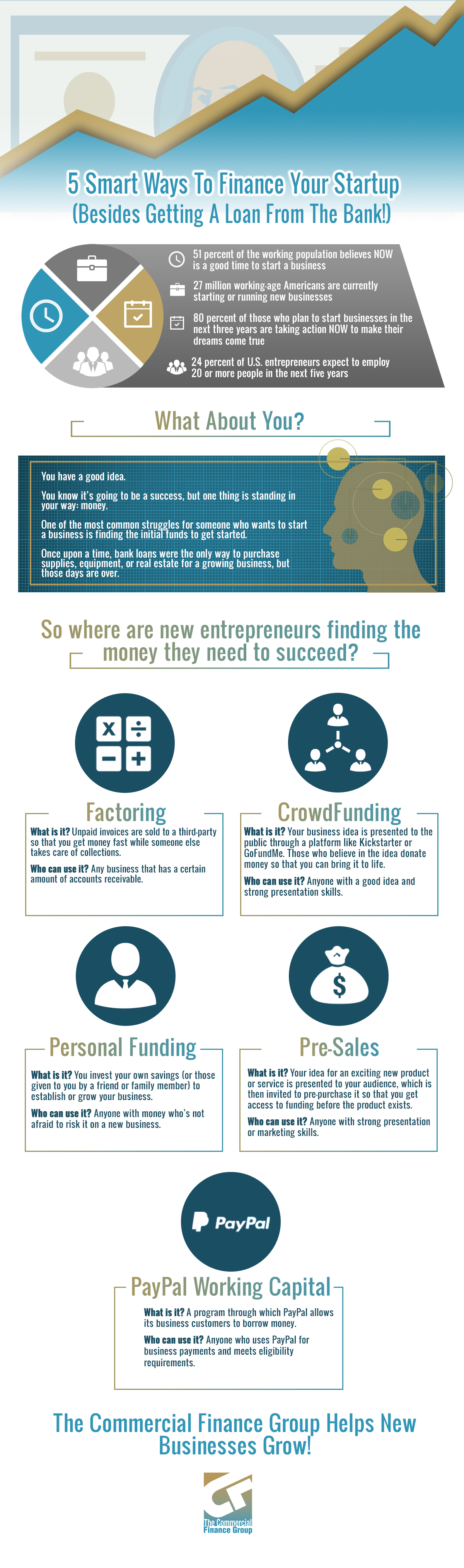

Small-Scale Entrepreneurship Is Exploding In America

If you have dreams of starting your own business, you’re not alone. In recent years, entrepreneurship in America has exploded, with more people than ever taking action to become their own bosses. Take a look at these incredible statistics:

- 51 percent of the working population believes NOW is a good time to start a business

- 27 million working-age Americans are currently starting or running new businesses

- 80 percent of those who plan to start businesses in the next three years are taking action now to make their dreams come true

- 24 percent of U.S. entrepreneurs expect to employ 20 or more people in the next five years

Ways To Fund A Startup

Now that we’ve got you even more excited to realize your dream of entrepreneurship, let’s get down to the nitty gritty of making it happen. “You’ve got to spend money to make money,” as they say, and starting a business requires a fair bit of up-front investment. Finding this money can be one of the biggest barriers to entrepreneurship, as those with the best ideas don’t always have the deepest pockets.

So how does a bootstrapping, wannabe entrepreneur find the funds they need to bring their ideas to life? Here are five options:

- Factoring – If you’re already making a modest amount of money as a company, but finding that collecting on unpaid invoices is taking up a fair bit of your time and resources, factoring could be a great way for you to free up cash for expansion. Through this process, your outstanding invoices are sold to a factoring company at a slight discount. They take on the task of collecting the money from your clients while you’re free to immediately reinvest that capital in your business.

- CrowdFunding – There was a time when only high powered executives and venture capitalists could invest in a promising business idea. Those days are gone, pushed aside by crowdfunding. Thanks to sites like Kickstarter and GoFundMe, anyone with a good idea can present it to the world and ask for contributions to bring it to life. While they’re far and few between, crowdfunding has allowed some of the best ideas to pre-fund themselves with millions of dollars without ever walking into a bank.

- Personal Funds – While it’s not the most preferable option self-investment is definitely still one of the most common funding methods. “While this might seem ridiculous to some, this could be one of your best options if you have the time, focus and patience to grow a business on your own,” explains Tech.co.

- Pre-Sales – This funding method is very similar to crowdfunding in that it promises those who contribute to your startup costs first access to your products. If you have the talent to package and present your future product in a way that gets people excited and ready to put their money on the table, this funding method might be right for you.

- PayPal Working Capital – Do you conduct business transactions online through PayPal? If so, you could be eligible for thousands of dollars in financing through their Working Capital program. The amount you can potentially borrow depends on how much business you are currently doing through their service and the history of your account.

The Commercial Finance Group Is Your Source For Factoring Finance

If you’re a new entrepreneur looking for financing options outside of the banks, contact us today. We’d be happy to walk you through the factoring process and explain how it could benefit your business. Learn more in the infographic below!