Here at The Commercial Finance Group in Atlanta, we’re proud of our long and successful history of providing financial solutions for businesses in distress. Through our factoring, asset-based lending, and receivables financing, we’ve helped many small to mid-sized businesses create working capital in a time of financial leanness. Whether caused from variables inside or outside the industry itself, our financial services allow companies to survive uncertain times and secure their future for many years to come.

As such, we challenge ourselves to stay up to date with the economic sector, always looking for signs that a particular sector is experiencing financial distress. This allows us to tailor our financial solutions toward the businesses that will need us most in the upcoming months and years.

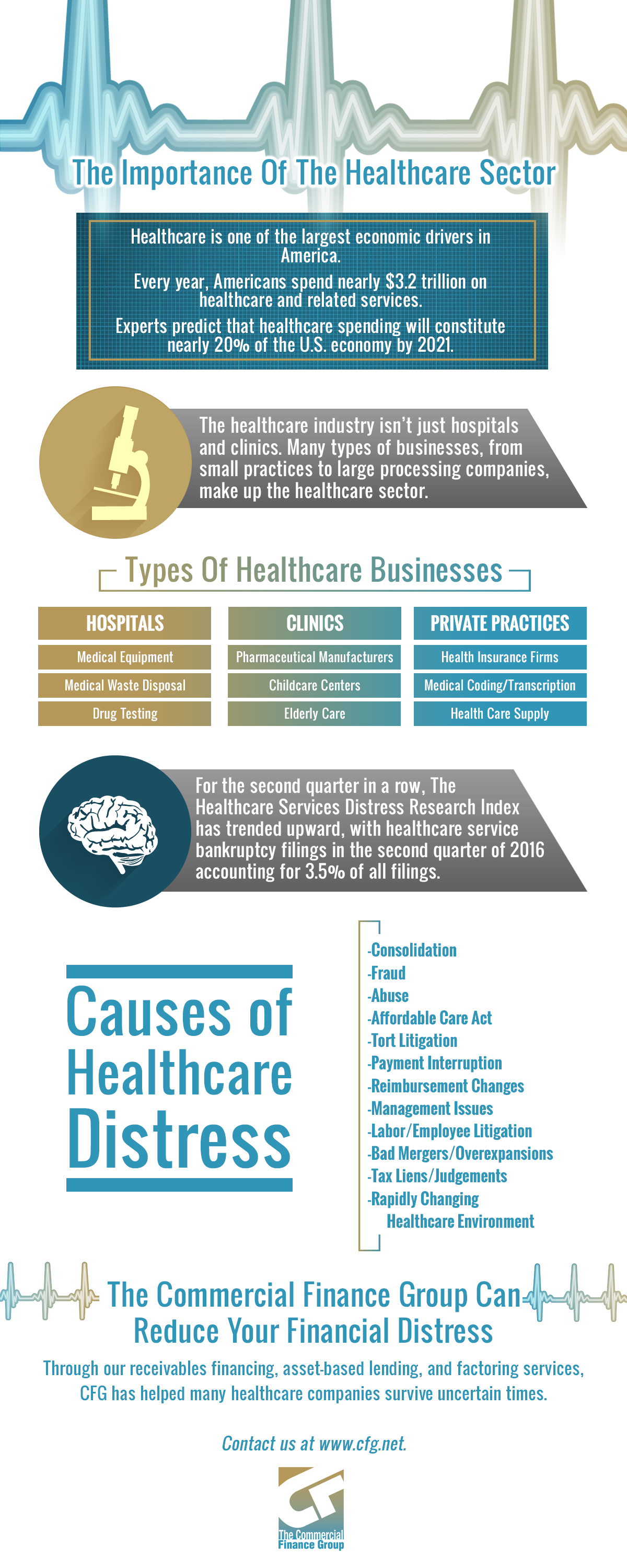

Troubling Signs In The Healthcare Services Distress Research Index

For commercial finance professionals, there are three indices that help us keep our finger on the pulse of economic health: the Chapter 11 Distress Research Index, the Real Estate Distress Research Index, and the Healthcare Services Distress Research Index. The Real Estate and Healthcare Indices are sub-indices of the Chapter 11 Index.

“In the second quarter of 2016, all three indices increased simultaneously. This is second consecutive quarter that this has happened, and these two most recent quarters are the only times that all three indices have increased together since 2010,” reports the ABL Advisor. “The Healthcare Services Distress Research Index, in particular, is the highest it has been since 2010, eclipsing the previous high from last quarter.”

Causes Of Financial Distress In The Healthcare Industry

If your business operates in the healthcare industry, you may have felt the “squeeze” of this index movement, but failed to identify the cause. In fact there is no one reason that distress is escalating in the world of healthcare, but several variables that may or may not be exerting pressure. These include:

- Ongoing consolidation – Hospitals and insurance companies are being acquired and merged into the holdings of larger corporations, making it difficult for smaller players to compete.

- The Affordable Care Act – Implementation of this revolutionary program has been incredibly complex and resulted in many uncertainties for all company types involved.

The two major causes of distress listed above have themselves triggered smaller negative consequences, including tort litigation, payment interruption, reimbursements changes and delays, management issues, labor/employee litigations, bad mergers and overexpansions, tax liens, and in general, a volatile healthcare environment.

CFG Can Help Your Healthcare Business Be More Secure

In a time of growing uncertainty for the healthcare industry, The Commercial Finance Group in Atlanta hopes to be a beacon of hope and stability. Through our financial solutions, particularly healthcare receivables financing, we’re uniquely positioned to help your pharmaceutical, childcare, medical coding, drug testing, or insurance company weather the storm caused by these distress variables.

Through receivables financing, we can take the burden of collecting unpaid invoices off of your plate, allowing you to focus on your patients, customers, and vendors. Break the feast or famine cycle with the help of The Commercial Finance Group! Contact us today.