Here at The Commercial Finance Group, we are proud to be your “bridge to bankability.” When you are just starting a business or are experiencing some financial struggles related to your business, traditional business loans can be hard to obtain — especially at a fair interest rate. We offer custom working capital solutions for small- and medium-sized businesses that provide the capital you need to continue to grow your business.

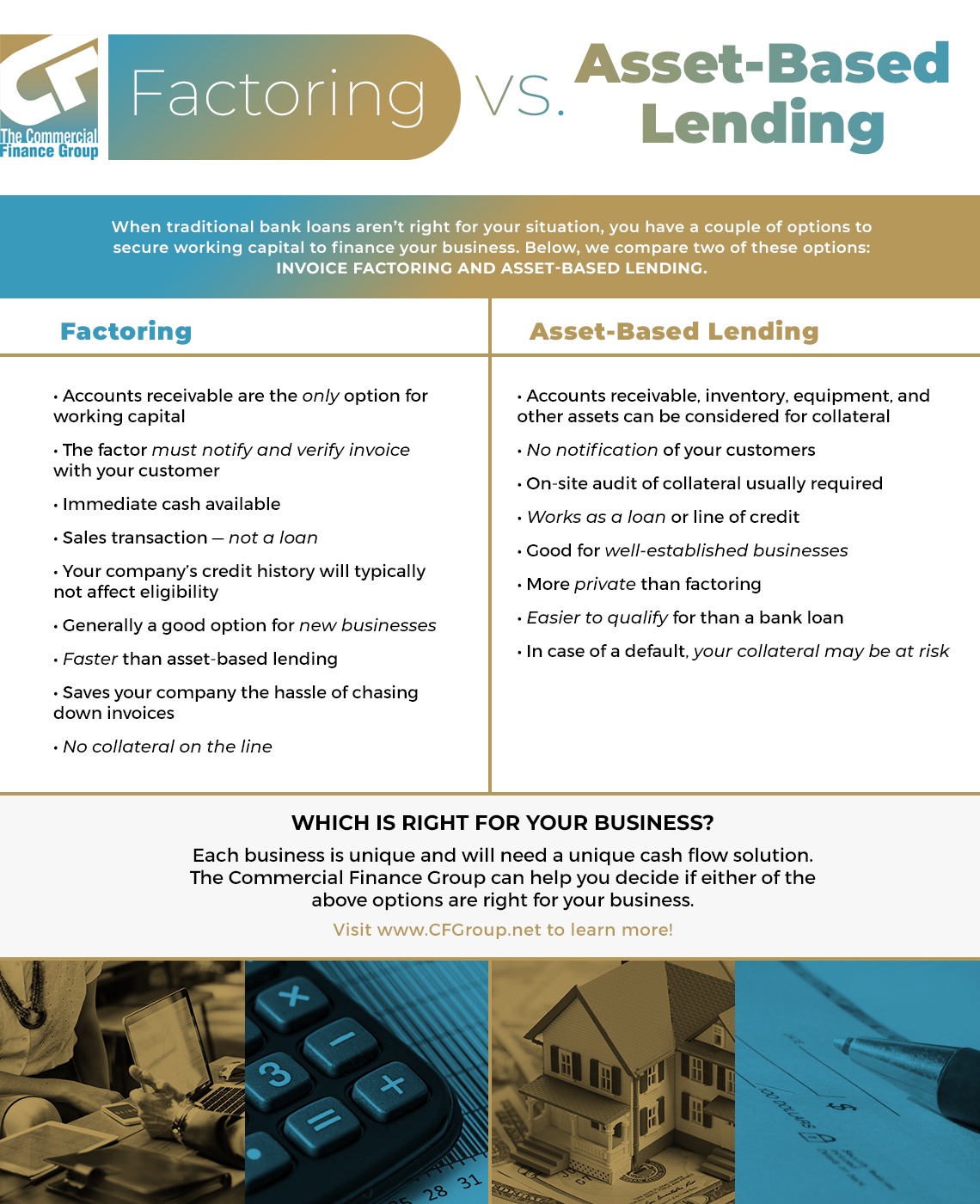

Two solutions we offer here at The Commercial Finance Group are factoring and asset-based loans. These options provide a cash flow, allowing you to continue to fund both short-term growth and long-term scaling. Below, we discuss both of these options, how they work, and what situations they work for. Of course, if you have any specific questions or are ready to get started, feel free to contact us.

Factoring

What Is It?

Factoring is a means by which a company can obtain a source of working capital without taking out a small business loan. During this process, a factoring company like The Commercial Finance Group will purchase your invoices. They will then take on the responsibility, risks, and rewards of collecting the invoice debt from your customers or clients. This gives you immediate working capital rather than waiting 30 to 90 days for your customers to pay their invoices, or longer if they are making late payments or no payments at all.

How Does Factoring Work?

Factoring may seem complicated, but the process is actually quite logical. First, a customer will purchase a product or service from you and will typically have 30 to 90 days to repay you. When your business can’t wait that long for repayment, you can sell your customer’s debt to a factoring company for about 75 to 90 percent of the face value of the invoice. The factoring company will then make the initial payment to you and work with your customer directly to collect the full invoice payment. After the full invoice payment is collected, the remaining balance will be paid to you, minus any interest or fees agreed upon — typically between just 1 and 5 percent of the invoice.

Who Is It For?

Factoring is typically best for new or small companies who cannot take care of day-to-day expenses like rent and payroll while awaiting payment from clients. It is also important that the clients you work with are creditworthy. Because the factoring company takes on a financial risk when purchasing an invoice, you will typically accrue lower fees or interest if they know the company has a perfect payment history.

Because this is a purchase and not a loan, there are no monthly repayments or installments. For this reason, this could be a good option for a start-up company who might not be able to keep up financially with a traditional loan and needs working capital quickly.

Asset-Based Loans

What Is It?

Asset-based lending, or asset-based loans, are loans that are secured using a company’s assets as collateral. Collateral assets can include inventory, equipment, real estate, and even accounts receivable as in factoring.

How Does Asset-Based Lending Work?

For asset-based loans to transpire, the lender needs to calculate the value of the collateral you can offer. Once this value is determined, you can borrow a percentage of that amount and use that capital for business expenses. As your assets increase, we can reevaluate your assets and increase in the borrowing amount as needed.

Who Is It For?

Asset-based loans are great for companies that need working capital to thrive. While many people assume asset-based loans are for companies that are experiencing financial woes, many thriving companies use asset-based lending options to keep a steady flow of cash during high-growth periods.

Asset-based loans are also a good option for companies who have sporadic earnings that might not qualify for a traditional bank loan.

One thing to keep in mind when deciding between factoring or asset-based lending is the privacy element. When you factor with us, we purchase your accounts receivable from you and take over the task of collecting the invoices. This means that your clients will know you are using a factoring company to help fund your business. While this isn’t necessarily a bad thing and is actually quite common, it is something you should be aware of when choosing to use business factoring services. Asset-based lending, on the other hand, typically does not involve your customers unless you are using accounts receivable as collateral.

Which Working Capital Solution Is Right For My Business?

When deciding between asset-based loans and invoice factoring, there is no universally “better” option. Several elements will need to be evaluated about your business and your needs, and The Commercial Finance Group is happy to discuss cash flow solutions with you. With over 40 years in business and over 250 years of combined experience among our management team, we have vast industry knowledge and can help you understand your options and make the best decision for your business.

Get In Touch With The Commercial Finance Group To Learn More!

We want to help your business succeed and grow by providing you with working capital solutions that fit your needs. We know that small business funding doesn’t have a one-size-fits-all solution, so we work hard to create a custom option that works for you. Get in touch with The Commercial Finance Group today to discuss factoring or asset-based lending.