For Businesses With Higher Leverage, Erratic Earnings, or Marginal Cash Flow.

How Asset-Based Loans Work

These loans are based on the assets pledged as collateral and are structured to provide a flexible source of working capital by monetizing assets on the balance sheet. While troubled companies often rely on asset-based lending (ABL) to provide turnaround, recapitalization, and debtor-in-possession (DIP) financing, ABL is also used by healthy companies seeking greater flexibility in executing operating plans without tripping restrictive financial covenants. Asset-based loans are structured with advance rates being tied to a specific percentage of eligible collateral according to their respective asset classes.

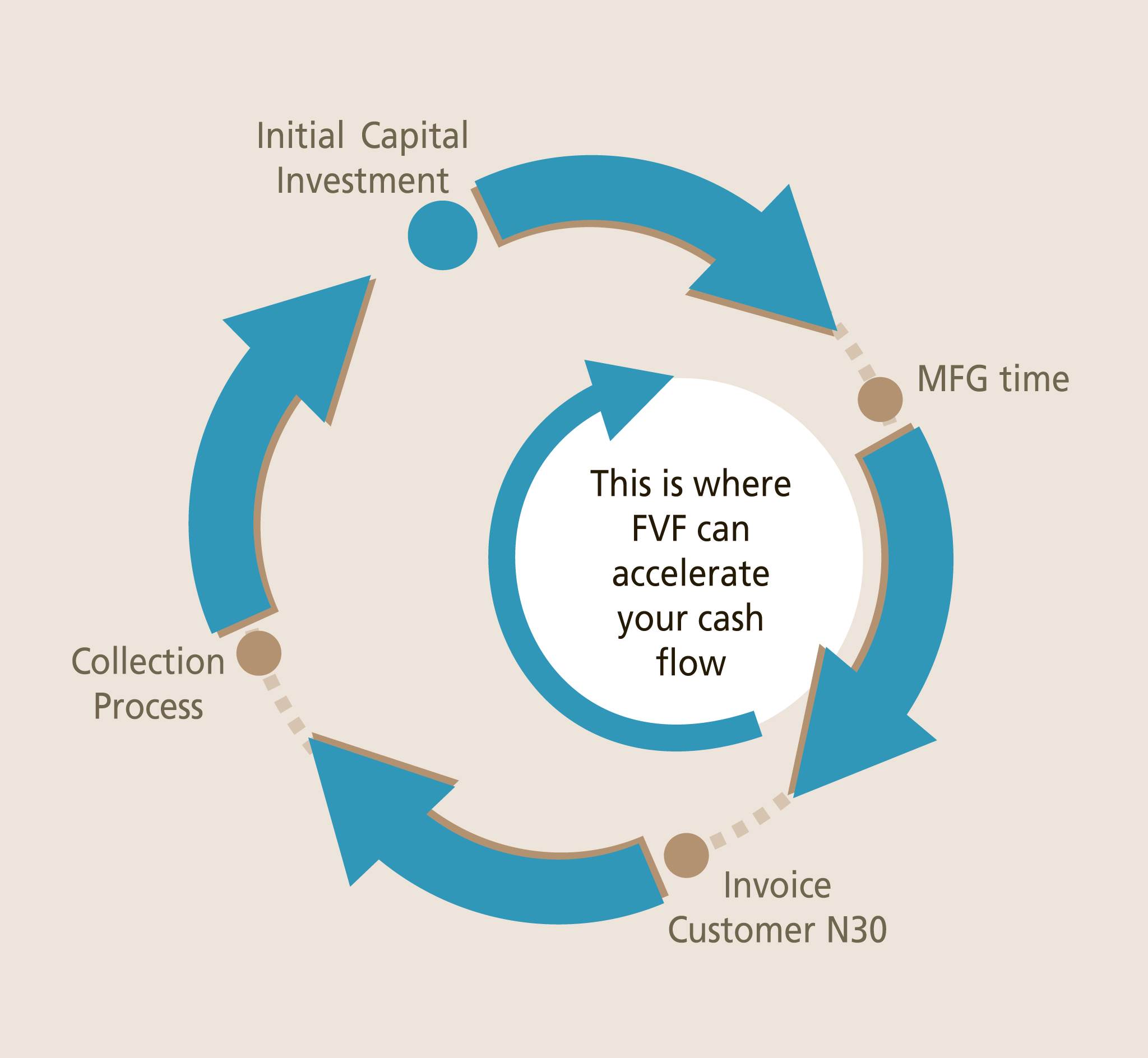

For example, Account Receivable having a higher advance rate than Inventory. The repayment of asset-based loans happens as the assets convert to cash in the businesses typical “business life cycle.” Inventory gets sold, is turned into an Account Receivable, A/R is collected and paid back against the loan. The cycle repeats as the company continues to build inventory, generate A/R, and collect remittance from its customers.

Contact us if you’d like to know more about our asset-based financing options. This funding solution can be the right fit for a variety of companies, particularly those looking for a quick business loan.

Key Benefits to ABL

How The Commercial Finance Group Can Help

If you are interested in asset-based lending, our team is ready to help. We understand that business start-up funding is not always easy to acquire, which is why we offer unique funding solutions, such as asset-based lending and invoice factoring. Our team has decades of experience helping companies who are looking for new business financing options. We will help you think outside of the box and explore new business funding options. Our goal is to find the ideal solution for your specific company’s needs.

When we work with you, the process will begin by us getting to know your company, the story behind it, and the needs you are facing. We want to have a deep understanding of what your company’s goals are so we can determine what solution will be best for you. One of the things that sets our company apart from others in our industry is the detailed approach we take to every lending solution. We believe that every company is unique and we will never treat you with a one-size-fits-all attitude. We don’t only consider your present needs, but we also consider where your company is headed in the future. If asset-based lending is right for you, we will let you know and we will explain what options will work for you. Whether you utilize inventory, invoices, or another asset, this methodology will allow you to access capital for your business that you need for growth and other important tasks, such as paying payroll, investing in new equipment, and more.

If you have previously hit the wall on a hunt for quick business loans and traditional lending is not an option for your company, turn to the experts at the Commercial Finance Group. We look forward to finding the right solution for you. Talk to us today about asset-based lending options and find out if this is the answer you have been waiting for.